Tópicos em alta

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Streaming Services are on a tear.

No, I don't mean Netflix.

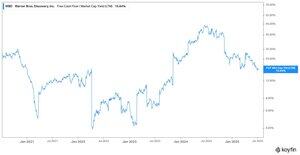

Take a look at Warner Brothers $WBD.

Up 46%, like Netflix, in 3 months.

Warner Brothers Free Cashflow yield is 16%.

Price to Free Cashflow is 6x.

What's funny is you have firms like Ariel Investments claim that they buy public markets assets that trade at a discount of 20%+ to private market values.

They don't actually do that as far as I can tell (Las Vegas Sphere!?)

This, on the other hand, is actually an example of that.

Content owners like Warner Brothers - and others - should be able to license and monetize their IP in the Age of AI as well.

That's not the underwrite - that's the right tail scenario if management gets a clue.

This is also another example of 'mean reversion' at work, and hated non-consensus names working very well in this environment.

Yes, we own WBD.

$NFLX $WBD

Melhores

Classificação

Favoritos