Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Osa 2: Suorituksen laatu ja reititysvirheet

Tässä on suodatettu otos viimeisen viikon kaupoista, jotka ovat todennäköisesti vähittäiskauppaa eivätkä botteja

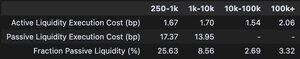

Alla oleva taulukko näyttää keskimääräisen täyttölaadun, jos sinut ohjataan aktiiviseen likviditeettiin DEX (tumma AMM tai Clob) vs. passiivinen kaupan koon perusteella ($)

4.8.2025

Solanan markkinarakenne muuttuu kuukausittain tässä vaiheessa, ja suurin osa julkisista kojelaudoista on epätäydellisiä

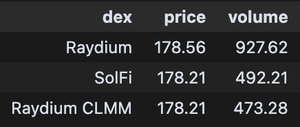

Joka tapauksessa vedin tiedot viime viikolta ja siellä on uusi hallitseva tumma AMM

tässä on tiedot SOL-markkinoista Jupiterin kautta ohjatuille kaupoille

Ensimmäinen asia, joka on huomattava, on, että jos olet tarpeeksi epäonninen ja sinut ohjataan passiiviseen AMM:ään, täytteesi on todennäköisesti noin 10 kertaa huonompi

Osoittautuu, että tätä ohjaa ensisijaisesti alkuperäinen Raydium V4 AMM, joka saa paljon enemmän virtausta kuin täyttölaadun perusteella pitäisi

Tässä on esimerkki havainnollistamaan. Käyttäjä ostaa Jupiterista ja se reititetään samanaikaisesti Raydium V4:n, Raydium CLMM:n ja Solfin kautta

Täyttö on lähes 20 bps huonompi Raydium V4:llä kuin Remaning Two Dexes

TX:

Minulle on epäselvää, miksi näin tapahtuu. Mahdollisesti sim on vain väärä. Tai ehkä Raydium DeX näyttää hyvältä sekunnin murto-osan, mutta se on loppunut paljon ennen kuin käyttäjä TX laskeutuu

Käyttäjien suoritusten laatua on paljon parantamisen varaa vain reitittämällä täytöt parhaille Dexeille

11,8K

Johtavat

Rankkaus

Suosikit