Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

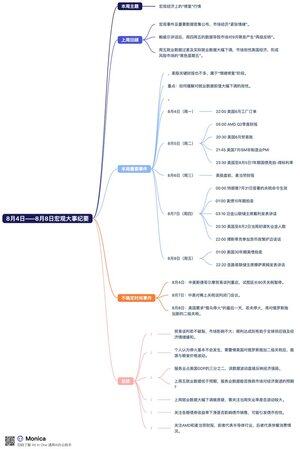

August 4th Crypto Comprehensive Daily Report

Introduction:

On the first day of the macro recovery market, the market is relatively calm, temporarily regaining rationality. Risk assets are cautiously rebounding, continuing to wait. This week's theme is macro recovery; no bad news is good news!

The China-U.S. Stockholm trade negotiations continue, focusing on the themes of "extension of trade pause" + "rare earth trade issues," suspected of using rare earth trade to exchange for a 90-day extension!

Geopolitics:

1. The movie "731" is officially scheduled to be released on September 18, 2025.

2. The third round of trade negotiations between China and the U.S. continues in Stockholm, Sweden, focusing on trade delays and rare earths.

3. The China-Russia naval exercises continue.

4. U.S. envoy Steve is expected to visit Moscow on August 6 to promote Russia-Ukraine peace talks.

Assessment:

Today, there are no suspected crises in the geopolitical arena, with only two points of focus:

1. Remember to go see this film on September 18, and do not forget national humiliation.

2. In the China-U.S. trade negotiations, it appears that the U.S. wants to pause tariffs for another 90 days in exchange for concessions on rare earths from China. In the future, this could be a 90-day condition exchange, possibly a regular tactic.

Macroeconomic Events

After last week's employment data raised economic concerns, this week is focused on the "macroeconomic recovery" trend, observing how various data can stabilize the market while ensuring the probability of a rate cut in September.

There are no important macroeconomic data today. The accompanying image is the macroeconomic masters' summary for this week, which can be saved. Important data and events will start from Tuesday.

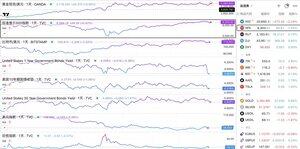

Global Market

1. Gold rose 0.48% today, priced at $3,380 per ounce, with potential safe-haven sentiment still present.

2. International crude oil fell 2.34% today, currently priced at $68.06 per barrel, affected by OPEC+ production increases.

3. The dollar index has declined, with the U.S. Treasury yield spread weakening, leading to short-term selling of the dollar.

4. One-year short-term bonds have slightly rebounded, while 10-year and 30-year long-term bonds continue to decline, influenced by the probability of a rate cut in September and last week's employment data, increasing the likelihood of safe-haven and rate easing, which has led to a rise in short-term U.S. Treasury prices.

5. U.S. stocks opened with the Nasdaq down, while the S&P, Russell, and Dow Jones maintained gains; the U.S. stock market is currently in a normal correction phase, temporarily stabilizing with optimism.

6. The VIX index has dropped to around 18.21, continuing to decline compared to the afternoon, with market sentiment in a stable optimistic phase.

Assessment:

The overall market is still influenced by last week's employment data and the increased probability of a rate cut in September, maintaining stability and optimism for now.

Pay attention to the impact of the decline in one-year, ten-year, and thirty-year U.S. Treasury yields on bond market auctions this week.

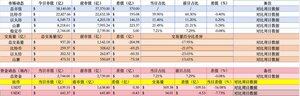

Market Data:

1. Market capitalization has increased, with #Bitcoin's share dropping below 60%, while #ETH's share of altcoins has increased, and market risk appetite continues the optimism from the weekend.

2. Trading volume continues to decline, with a drop of about 20% compared to Sunday, indicating that the market is still in a low liquidity phase.

3. On-site retained funds have increased by 500 million, currently totaling 274.4 billion.

4. USDT: Official website data shows a market cap of 163.905 billion, an increase of 0.011 billion compared to yesterday. Although the inflow is small, the Asian market still maintains a net inflow of funds.

5. USDC: Data from the website shows a market cap of 0.043 billion, with funds from the US continuing to experience net outflows for the second week in a row.

Assessment:

The market continues the optimistic sentiment from Sunday; however, caution is needed as it remains in a low liquidity phase, and the market has not fully activated. On the other hand, while USDC is experiencing continued outflows, the overall magnitude is small, and the US ETF side continues to see inflows, resulting in relatively minor short-term negative impacts.

Bitcoin Technical Analysis:

A. Market Interpretation

1. The one-hour result attempts to break through the one-hour resistance. After experiencing weekend fluctuations and corrections, the range has shifted from a downward to an upward phase, with slight divergence in the range.

2. The four-hour price is at the upper boundary of the range, currently attempting to break through the key resistance level of 115,300. After experiencing fluctuations and corrections, the range has gradually turned upward, with no divergence in the range.

3. The daily price is at the lower boundary of the range, and this is currently the second daily K of the rebound. As the daily line continues to fluctuate upward, the signal for stopping the decline becomes increasingly clear, proving that my previous logic was correct. The first wave of the three-wave correction has completed, and the next is the second wave of the rebound.

B. Support and Resistance

Support: Short-term support around 114,000, key support around 111,900. If this position is broken, the daily stop-loss signal will fail.

Resistance: Short-term resistance at 115,300, with key resistance this week around 117,000.

C. Other Indices

RSI: 1 hour 67, 4 hours 54, daily 49.38. The hourly level has entered a strong bullish phase, while the daily level is still in a weak bullish range.

CME: The BTC futures index has a 400-point premium over spot, indicating temporarily strong bullish demand in the futures market, but weaker compared to last week.

Today's Market Summary:

1. On the macro front, Monday is temporarily in a vacuum period. After the market experienced a weekend adjustment, it is currently in an emotional recovery phase, cautiously optimistic. At this time, be aware of any negative news that may arise.

2. The global market is currently relatively stable.

3. Although the crypto market continues the optimism from Sunday, it still belongs to a low liquidity phase. One should be cautious as any news stimulus could lead to increased volatility.

Trading Thoughts:

Continuing with Sunday’s thoughts, the hourly level shows a stop-loss rebound, and the subsequent movement is a fluctuating upward trend. The daily stop-loss signal is clear, indicating the end of the first wave of the three-wave correction, and the next is the second wave of the rebound.

The rebound wave needs to pay attention to the breakthrough and stabilization of the resistance level at 117,000. If it breaks through, as long as the price does not break below around 119,800, new highs are not considered for the time being.

This is because the second wave of the rebound from the correction cannot exceed the previous daily high; otherwise, the logic will be broken. If it aligns with the second wave trend, then we will look at how to proceed with the third wave of the correction.

At the current stage, we temporarily consider it to be in the second wave of the rebound, so we are looking at a fluctuating upward or fluctuating rebound phase. Of course, we need to pay attention to whether uncertain macro factors disrupt the originally established trend.

The K-line trend is just one of the probable trends we believe in, but macro factors can interfere with the original trend, so do not be overly rigid; use flexibility.

25,11K

Johtavat

Rankkaus

Suosikit