热门话题

#

Bonk 生态迷因币展现强韧势头

#

有消息称 Pump.fun 计划 40 亿估值发币,引发市场猜测

#

Solana 新代币发射平台 Boop.Fun 风头正劲

市场下跌

清算增加

SVR 收入上升

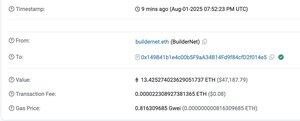

刚刚在一笔交易中回收了 47,000 美元的 MEV,昨天在另一笔交易中回收了 22,000 美元,在这段波动期间还有数十笔交易,每次收集数百/数千美元

这种逆周期的、丰收或饥荒的收入开始真正扩大

更多的借贷市场继续与 SVR 集成,以回收更多的清算 MEV 机会,回收率超过 90%,未来还会有更多增长

@eliottmea 换句话说,Chainlink 是在为用户节省资金,做着与你所说的完全相反的事情。

@HaiderBhatti96 @bob4punk Aave 的以太坊 TVS 大约占 75%,或 OEV 可寻址 TVS 的 95%

2025年6月27日

Following the success of phases 1 and 2, the Aave DAO has officially voted with unanimous approval to enter phase 3 of its activation of Chainlink SVR.

Phase 3 expands Chainlink SVR's coverage to ~75% of Aave's total Ethereum TVS, which represents ~95% of Aave’s OEV-relevant TVS, based on historical data.

With this expansion, SVR has the opportunity to capture a greater amount of MEV for the Aave and Chainlink ecosystems.

SVR is a novel oracle solution that allows Aave to securely recapture oracle-related liquidation MEV, with the recaptured value split between Aave and Chainlink.

Since launch, SVR has operated without issue, successfully liquidating at-risk positions while ensuring zero bad-debt accrual for the Aave protocol.

As part of Phase 3, SVR-activated markets now include all ETH-correlated assets (WETH, wstETH, weETH, etc.) and USDC.

Remaining assets will be considered in a follow-up vote due to their unique token mechanics or other considerations that require extra due diligence.

This expansion reflects a risk-adjusted approach to increasing Aave's usage of SVR, with the ultimate goal of having all Aave markets on @ethereum covered by SVR.

Thank you to @aave and @bgdlabs for their continued support in building a new economic primitive for DeFi.

Just use Chainlink.

45.97K

热门

排行

收藏