Populære emner

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Store nyheter for alle finansieringsrentehandlere.

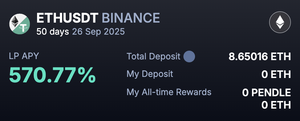

@pendle_fi har lansert Boros @boros_fi, en ny onchain-plattform på Arbitrum som lar brukere handle finansieringsrenter fra CEX-perps som Binance, i stedet for prisen på eiendeler som $BTC eller $ETH.

I stedet for å spekulere i prisretning, introduserer Boros Yield Units (YUs, lik YTs på Pendle), YU-ETH representerer finansieringsavkastningen fra 1 ETH perp, slik at brukere kan gå long hvis de forventer at finansieringsrentene vil stige eller short hvis de forventer at de skal falle.

Dette låser opp et nytt lag med strategi, spesielt for protokoller som @ethena_labs, med en TVL på nesten 10 milliarder dollar, som er avhengig av positive finansieringsrenter for å generere stablecoin-avkastning og kan nå sikre mer effektivt uten komplekse OTC-oppsett.

Tidlig trekkraft er sterk med $800k allerede satt inn i Liquidity Vaults.

Med $10 millioner OI-tak per par (BTC/ETH bare foreløpig), 1,2x innflytelse og støtte som utvides snart, er Boros kanskje ikke detaljhandelsvennlig ennå, men jeg planlegger allerede å forberede et par innlegg om hvordan vi kan sikre posisjonene våre der.

Videre er det ikke noe 2nd token, noe som gjør $PENDLE enda mer verdifullt ettersom det vil bli brukt til insentiver og alle handelsgebyrer anskaffet av protokollen.

En stor milepæl ikke bare for Pendle, men for hele kryptoområdet. Virkelig spent på teamet og ønsker dem stor suksess fremover.

Topp

Rangering

Favoritter