Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

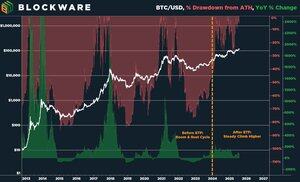

I don't understand how someone can look objectively at the chart of BTC/USD and not recognize the DRASTIC shift in price action after the creation of the ETFs

The "cycles" are OVER

Future bear markets will be ~30% drawdowns (I'd hardly call that a bear market by Bitcoin standards)

With institutional capital comes institutional instruments and institutional behavior

Make a nice gain on BTC? Historically, the only way to "hedge" or "take profits" was to sell, catalyzing bear markets which were exasperated by panic

Now there's no shortage of instruments to hedge BTC/USD exposure after a bull run

> Sell $IBIT calls or buy $IBIT puts (in-kind redemptions will make this seamless even for those who keep their stash in cold-storage).

> Rotate into $STRC or $STRF (which will ultimately funnel that capital back into BTC).

Moreover, the new cohort of Bitcoin investors (the suits) aren't looking for 1,000x returns in a year. They're used to treasury bond & S&P returns. If they're up 50 to 100% in a year on BTC, they are GOING to hedge themselves.

Passive inflows via Corporate BTC Adoption and $MSTR inclusion in NASDAQ and other indices will also provide downside support.

Yes, Bitcoin will remain volatile relative to traditional assets.

Yes, Bitcoin will outperform traditional assets.

No, Bitcoin is not going to go up 2,000% in a year like it did in 2017 -- and that's okay.

The only people raging out at this take are those who aren't fully ported.

BTC putting up a 30% CAGR for the next 10 years will make you sufficiently wealthy if you're sufficiently long.

26.7.2025

BTC/USD looks like two entirely different assets before and after the ETF

The days of parabolic bull markets and devastating bear markets are over

BTC is going to $1,000,000 over the next 10 years through a consistent oscillation between “pump” and “consolidate"

It will bore everyone to death along the way and shake the tourists out of their positions

Strap in

239,81K

Johtavat

Rankkaus

Suosikit