Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

Ever wondered about the size of the fixed income market?

Here's the scoop: it's 5x larger than equity markets, worth over $600T!

Now, @TreehouseFi is bringing that market on-chain - and Pill is positioning early with $TREE 👇

"Fixed income is boring"

But boring makes $$ and the tradfi whales know this (trillions in fixed income instruments)

$TREE will be live on major CEXs on day 1 (Binance Spot, Bybit Spot, OKX etc.) - and yes, you can stake right away through Treehouse dApp

Support the eco + earn real yield = win-win!

29.7.2025

🌳 This is Gaia: $TREE is now live!

It’s time to claim, stake, and shape the future of fixed income in DeFi 🌱

TREE powers utility, governance & alignment across Treehouse—the Decentralized Fixed Income Layer.

Welcome to Gaia. 🧵👇

[updated live]

@TreehouseFi is laying the foundation for fixed income in crypto via these two core primitives:

→ tAssets (yield-bearing LSTs e.g. $tETH and more to come such as tSOL, tAVAX)

→ DOR (Decentralised Offered Rates)

"So what’s DOR?"

Imagine if ETH had its own “Fed Rate,” but instead of 12 people in suits, it's a consensus of top-rate forecasters.

Panelists predict interest rates → data is aggregated → becomes the benchmark rate

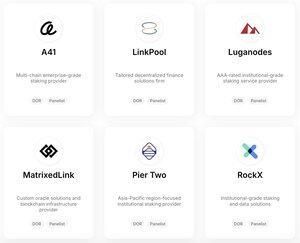

For @TreehouseFi , they've started with 3 different DORs, backed by legitimate big names (Staking Rewards, RockX etc.)

1) TESR (Treehouse Ethereum Staking Rate

2) TELR (Treehouse Ethereum Lending Rate)

3) TEBR (Treehouse Ethereum Borrowing Rate)

Read more here:

$TREE is essential - not just powering the ecosystem, but it's your gateway to shaping @TreehouseFi 's future

For builders and partners, $TREE becomes a requirement.

For everyone else, it's how you earn from the rate revolution.

Do you see the flywheel here? Real alpha.

27.7.2025

2️⃣ Where Utility Meets Alignment

$TREE isn’t just a governance token. 💎

It’s integrated into the core mechanics of the Treehouse ecosystem:

⬩Query fees for DOR usage

⬩Panelist staking

⬩Consensus payouts

⬩Protocol governance

⬩DAO grants for builders & partnerships

Here’s why Pill is considering staking $TREE 👇

→ Pill expects TREE demand to grow as DOR adoption spreads (fixed income is a very real and needed market)

→ Get that 50%+ APR

Claiming now is cool, Pill understands

But staking might be the giga-brain move now

Recap:

• Treehouse = DeFi’s fixed income engine

• tAssets + DOR = new primitives

• Stake TREE in Panelist Vaults

• Earn 50% to 75% APR

• TREE live and listed on CEXs

Pill's betting big on rates - the biggest opportunities often look boring at first.

Early on DeFi fixed income with TREE

@monosarin

@0xAndrewMoh

@CryptoShiro_

@poopmandefi

@eli5_defi

@marvellousdefi_

@0xCheeezzyyyy

@crypto_linn

@YashasEdu

@CipherResearchx

@splinter0n

@belizardd

@lenioneall

@FabiusDefi

@St1t3h

@the_smart_ape

@cryppinfluence

@TheDeFiPlug

@defi_mago

@0xDefiLeo

@kenodnb

@bullish_bunt

@Mars_DeFi

@nursexxl

@0xTindorr

@PenguinWeb3

@Tanaka_L2

@0xKaiFi

@cryptorinweb3

@CryptoRick98

@rektdiomedes

@Nick_Researcher

@RubiksWeb3hub

What are your thoughts?

Thanks for reading till the end, hope you enjoyed it!

Disclaimer: All opinions expressed remain objective, and are for informational and/or entertainment purposes only. NFA, as always DYOR.

I will be diving deeper and sharing more alpha along the way!

30.7.2025

Ever wondered about the size of the fixed income market?

Here's the scoop: it's 5x larger than equity markets, worth over $600T!

Now, @TreehouseFi is bringing that market on-chain - and Pill is positioning early with $TREE 👇

5,25K

Johtavat

Rankkaus

Suosikit